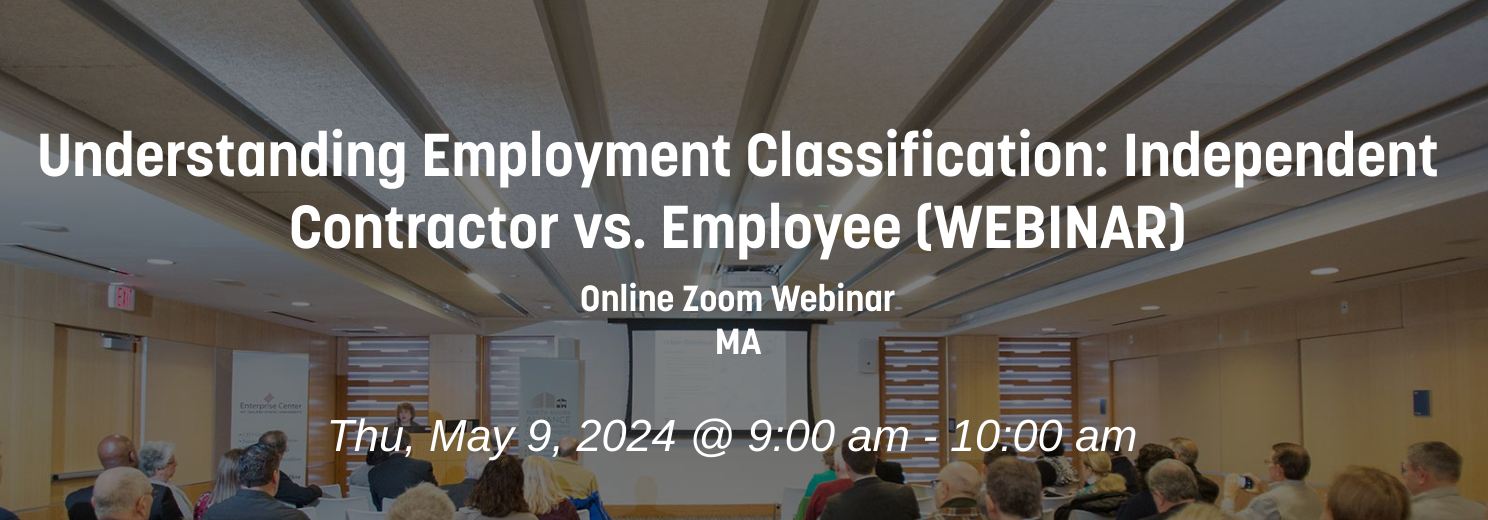

Date & Time

May 09

9:00 AM - 10:00 AM

About this Event

Any business owner who hires workers should be able to distinguish between independent contractors and employees, thoroughly understand their duties as an employer, and be aware of the additional legal protections afforded to employees. This insightful webinar will focus on Massachusetts and federal employee classification laws and regulations and increase your knowledge of how to classify workers.

Course Overview:

This webinar will provide participants with a comprehensive understanding of the legal framework surrounding the classification of workers as independent contractors or employees. Attendees will gain valuable insights into the following key areas:

-

- Legal Requirements: Explore the legal obligations imposed on employers and the rights afforded to employees under Massachusetts law, including minimum wage, overtime pay, and workplace protections.

- Reasons for Classification: Explore the motivations behind businesses preferring to hire independent contractors and the implications for both employers and workers.

- The Three-Part Test: Learn about the three-pronged test used in Massachusetts to determine whether a worker qualifies as an independent contractor, focusing on factors such as control, nature of the work, and trade independence.

- Federal Standards: Learn about the Internal Revenue Service (IRS) guidelines for distinguishing between independent contractors and employees, including the famous “twenty-point test.”

- Penalties for Misclassification: Become aware of the potential consequences of misclassifying workers, including criminal enforcement, civil penalties, and lawsuits.

Who Should Attend:

-

- Business Owners

- Human Resources Professionals

- Independent Contractors

- Anyone interested in understanding employment classification laws and regulations

Key Takeaways:

By the end of this webinar, participants will have a clear understanding of the criteria used to differentiate between independent contractors and employees, along with practical strategies for ensuring compliance with relevant laws and regulations.

Registration is required to attend this webinar. The Zoom link will be emailed to registrants prior to the webinar.

This informative webinar is offered at no cost and is being sponsored in partnership with Northeast Legal Aid, the North Shore Alliance for Economic Development and the Massachusetts Office of Business Development (MOBD). Maria Di Stefano, Northeast Regional Director, will provide an update on MOBD resources.